In the past few months, the global financial markets have been shaken by several high-profile bank collapses.

While mainstream media thinks the collapse of some traditional financial institutions is due to their involvement with cryptocurrencies, research suggests their exposure to digital assets was relatively minor, compared to other underlying problems.

These collapses stemmed from financial mismanagement, deregulation of the financial sector causing unsafe lending behaviour and economic shocks from unexpected events, such as the global supply chain disruption during the pandemic’s lockdowns.

It’s crucial to examine these failures closely.

Let’s explore the recent collapses of Silvergate Bank, Silicon Valley Bank, and Signature Bank, along with the takeover of Credit Suisse, shedding light on the main reasons behind these downfalls.

Sidenote: Please share and forward this newsletter, it really supports my writing and MyZucoins.

Silicon Valley Bank: Sinking Under Interest Rate Risks

The second-biggest bank failure in US history goes to Silicon Valley Bank (SVB).

Headquartered in Santa Clara, California, SVB succumbed to collapse in 2023, with nominal assets amounting to $209 billion. The primary cause of SVB’s failure was its extensive exposure to interest rate risks with undiversified assets—that is, they essentially focused on too many high-risk early-stage businesses and didn’t balance it out. As interest rates rise, the value of a bank’s fixed-income assets may decline, leading to significant financial losses. In SVB’s case, these losses overwhelmed the bank, causing its eventual demise.

Despite poorly informed headlines in many mainstream media outlets, the cause wasn’t over the excessive connection to cryptocurrencies. In fact the main affected cryptocurrency from SVB is the stablecoin USDC, issued by Circle. Even so, Circle’s assets equalled $3.3 billion of reserves in SVB’s total ~$209 billion. A mere 1.5% of the total.

Signature Bank: Risky Reliance on Unproven Startups and Investors

Next up on the podium is the collapse of Signature Bank, the third-biggest bank failure in US history.

Signature Bank’s issues primarily stemmed from its excessive dependence on clients involved with unproven startups and the funds investing in these ventures. Such clients presented a higher risk profile due to the uncertain nature of their financial success, with many defaulting on their loans. Consequently, Signature Bank experienced a surge in non-performing loans (NPLs), impairing its lending capacity and income generation, eventually leading to its collapse.

Silvergate Bank: The FTX Exchange Connection

In addition to typical trends of over-lending, Silvergate Bank’s revealed to the general public a deep association with the controversial FTX cryptocurrency exchange, operated by Sam Bankman-Fried. Although FTX represented less than 10% of Silvergate Bank’s total $11.9 billion in digital deposits, the bank suffered massive losses following FTX’s collapse.

Silvergate Bank reported a staggering $1 billion loss in the last quarter of 2022, with FTX being one of its largest clients. As a result, on March 8, 2023, Silvergate announced its decision to wind down operations and voluntarily liquidate the bank.

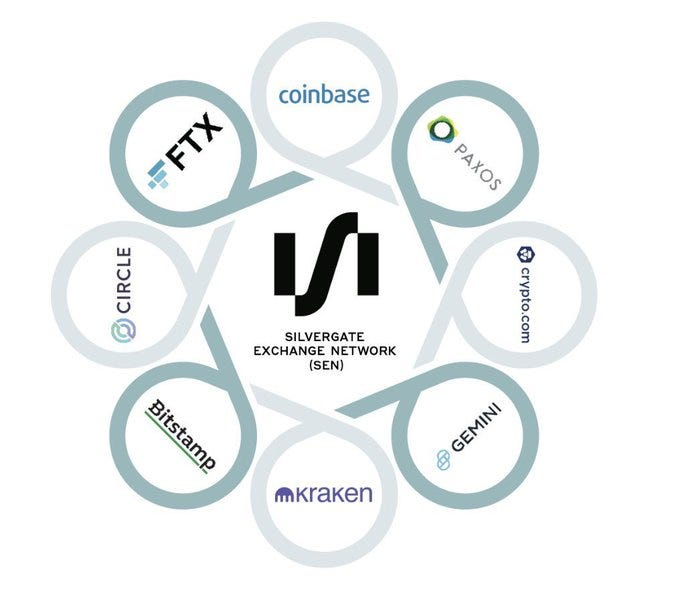

Silvergate’s underlying Exchange Network (SEN), was a leading cause of this uncontrolled lending in the crypto exchange space. Viewing the connected exchanges reveals that most of the recent issues in the world of crypto exchanges have come down simply to these parties and their bad practises, too interconnected.

The below image, that has since been removed from the Silvergate website, shows just how close the ties were. Each of these major crypto exchanges were swapping and cross-lending values via this network. When one domino falls, it hurts others:

Credit Suisse: Troubled Lender Caught in a Global Banking Storm

Credit Suisse, a troubled lender caught in a global banking storm, was taken over by rival UBS on Sunday, March 20, 2023. The seeds of its destruction were sown in the billions it lost when Greenhill Capital crashed in 2021.

The Swiss multinational investment bank and financial services company had been plagued by long-running problems, including highly illegal scandals, money laundering, shady deals and even spying.

Its latest crisis saw its shares drop to a record low. The Saudi National Bank’s refusal to take a larger stake in the poorly managed bank further exacerbated its issues. Credit Suisse tapped a lifeline of up to $54 billion from the Swiss authorities to shore up liquidity and investor confidence, helping its shares recover some ground after a nearly 30% slump.

The takeover by UBS demonstrates the extent of the turmoil within the global banking sector and highlights the importance of swift action and intervention to prevent further damage.

More Bangs and Pops to Come?

One effect of these acquisitions of banks into other bigger banks, is that unless the actions of the central banks and governments change, this will only move the issue upwards.

This means most likely, the next bank to potentially fail will be an even bigger bank.

Shift Towards Advanced Technology and Alternative Solutions

So what can we do?

The decline in trust within traditional financial institutions may lead to an increased demand for advanced technological solutions and alternatives. Zucoin, developed on the state-of-the-art Splitchain network, provides a forward-thinking option for those seeking to explore new financial opportunities and diversify their assets.

Growing Popularity of Decentralized Finance (DeFi)

As confidence in traditional banking systems wanes, the appetite for decentralised finance (DeFi) solutions may rise. Zucoin, backed by the sophisticated Splitchain network, is well-equipped to capitalise on this trend, as it offers a potential substitute for conventional financial systems. This heightened interest could boost the adoption and expansion of Zucoin and the Splitchain network.

The recent financial turbulence yet again emphasises the necessity for groundbreaking and disruptive ideas in the financial sector. Zucoin, with its foundation on the progressive Splitchain network, exemplifies such ingenuity. Offering a technologically superior option in comparison to traditional blockchain-based digital assets, Zucoin holds the potential to secure a substantial market share and catalyse significant changes in the financial landscape.

The Future Outlook?

The recent bank collapses outline the importance of recognizing and managing the diverse risks associated with current banking operations.

Each of these bank failures and the acquisition of Credit Suisse can be traced back to different factors – Silicon Valley Bank’s and Signature Bank’s exposure to interest rates due to excessive reliance on high-risk clients, Silvergate Bank’s connection to a controversial cryptocurrency exchanges, and Credit Suisse’s troubled management surfacing in the global banking storm.

These are clear lessons on the value of limited-supply assets.

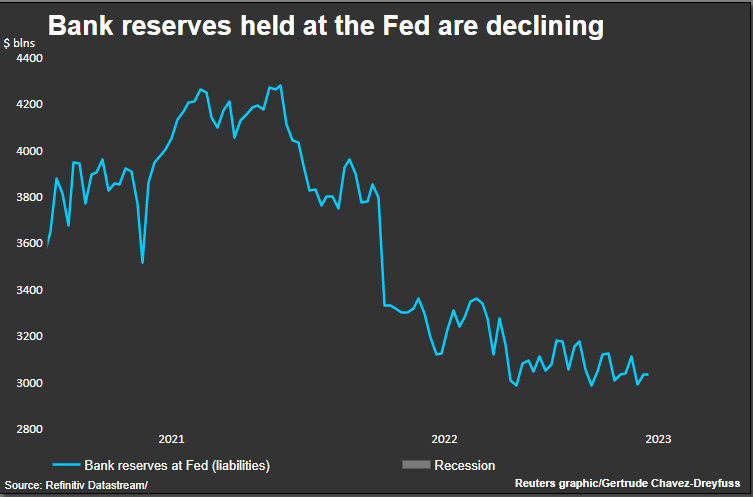

The recent pandemic era of lockdowns caused this artificially induced inflation environment. Central reserve banks had created stimulus measures and are now rapidly raising interest rates to counter those measures. In doing so, the governments and central banks of the world are knocking-around a fragile global supply chain football.

As consumers, it is our responsibility to remain vigilant and stay informed about the financial institutions we entrust with our hard-earned money. These events highlight potential opportunities and challenges for emerging financial technologies like Zucoin and Splitchain, such as:

- There’s a growing market sentiment and investor confidence in alternative assets

- Greater interest in Decentralized Finance (DeFi)

- Opportunity for innovation and disruption

- Coin supply is fixed, so there’s no lever to issue more coins and trigger inflation

As cutting-edge digital assets are built on the underlying Splitchain network, Zucoin is well-positioned to benefit from the changing financial landscape, driving innovation and offering an alternative to traditional financial systems.

What did you think of this newsletter? Reply to send me feedback on what you liked or want to see featured more. There’s more coming, so stay tuned.

If you liked this newsletter and want to support my work, the best way is to forward this newsletter to someone, donate here or even buy some Zucoins.

—

All the best,

Peter

MyZucoins