Welcome, and thank you for being part of the MyZucoins community! Let’s get into an interesting piece of crypto, finance, or tech news to stay ahead.

World’s Biggest Crypto Exchange, Binance, Is Melting Down

The titan of the crypto world, Binance, is facing increasing turmoil.

U.S. agencies are threatening more enforcement actions, causing a mass exodus of top execs and laying off 1,500 employees, painting a picture of a trembling empire.

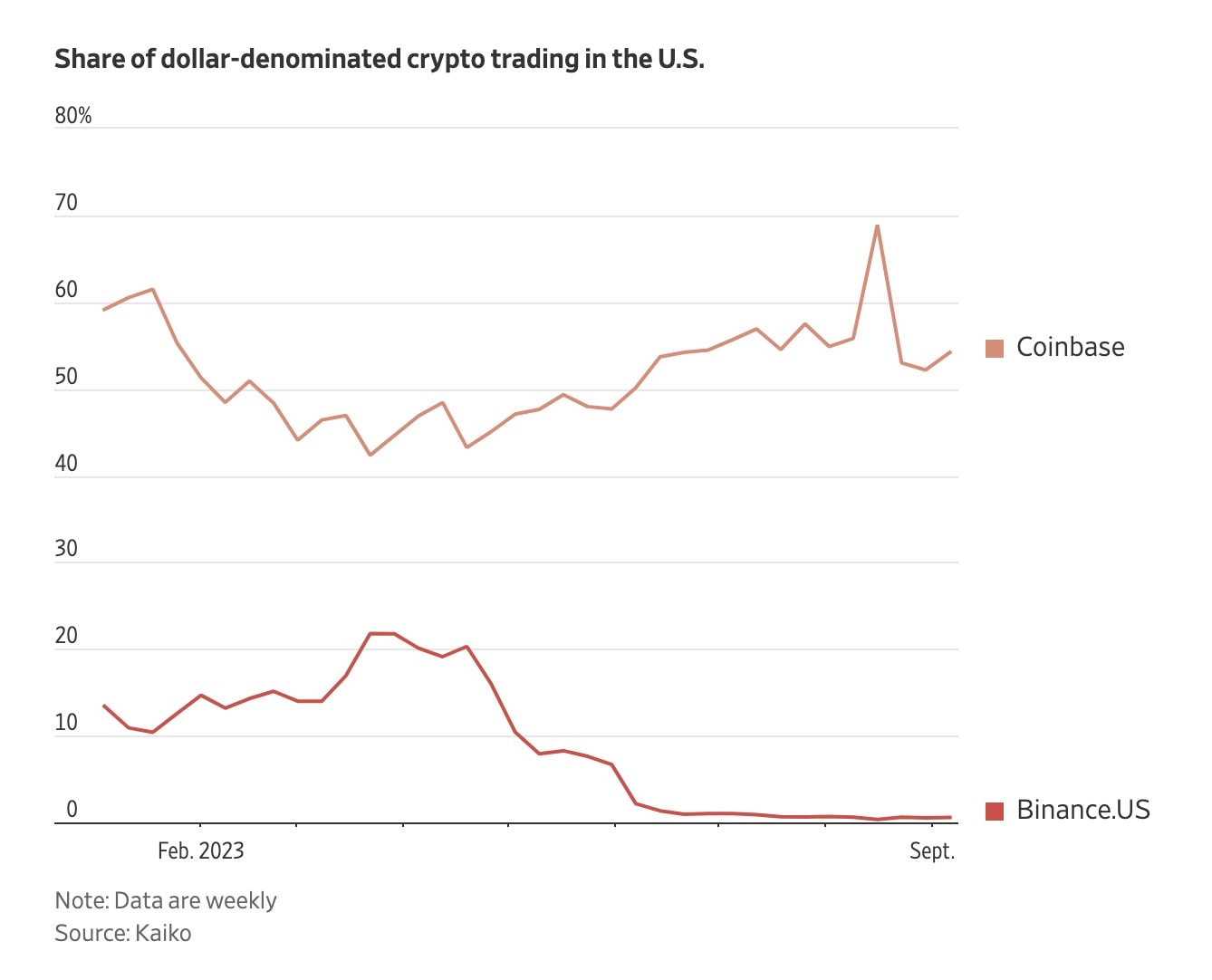

Binance’s share in crypto trades has dropped from 70% to 50% since the start of the year, according to Kaiko.

The potential downfall of Binance could ripple across the crypto industry, at a magnitude far bigger than FTX exchange’s collapse in 2022.

Some companies are even preparing for a “meltdown,” conducting drills to pull assets from Binance quickly in such an event.

In the midst of these challenges, Binance remains a significant player, investing in third-party projects, including X (formerly Twitter).

Co-founder Changpeng Zhao, known to his 8.6 million X (formerly Twitter) followers as CZ, is a key figure in the crypto world.

The U.S. Justice Department’s ongoing investigation into Binance and Zhao could result in criminal charges and fines in the billions of dollars.

Binance, launched in China in 2017, operates globally but is facing growing restrictions.

Many European countries have closed their doors to the exchange, and activity on its U.S. platform, Binance.US, has essentially dried up, according to data from Kaiko.

Revenue at Binance.US has fallen 70% this year, and key executives have departed.

The future will tell whether the tumultuous times Binance is navigating will lead to its downfall or a resurgence. Read more here.

Binance exchange’s UK setback, Zucoins’ Zutopia marketplace, announced.

Risky business – The dangers of many crypto exchanges.

Effects And Strategies For Cryptos Like Zucoins?

As the world of cryptocurrency grows, so do its challenges.

Centralized exchanges like Binance are facing issues due to regulatory troubles.

While we hope the team at Binance can take these knocks and build themselves back better, it’s important to consider the events unfolding across the generally high-risk industry of cryptocurrency exchanges.

If Binance continues to suffer, it could cause two things.

Firstly, the movement of crypto into more regulated exchanges, such as Coinbase.

Secondly, a deep correction for cryptos heavily reliant on market makers such as Binance that are holding up their token’s price.

While it’ll affect many cryptos, it won’t directly affect Zucoins as, of course, Zucoins isn’t on these exchanges.

The Zucoins team has been looking past exchanges for a while now, as the regulatory landscape has shifted in recent times.

Amid these concerns, a new platform called Zutopia is in the works.

It offers a different way of handling Zucoins, the main token of the Splitchain network.

Unlike Binance’s core exchange product, where the platform controls users’ tokens for them, Zutopia users keep their own assets in their own crypto wallets, such as using the Zucoins wallet app.

This lowers the chance of big problems if something goes wrong on the Zutopia platform.

The aim of Zutopia is to give people more power over their own transactions.

Sidenote: We’re aware Binance also has a peer-to-peer trading platform, but it hasn’t received anywhere near the attention and features needed to bring it front and center. Their centralized exchange seems to be their top priority and it’s what most people use when they think of “Binance”.

Safety is a big deal in the world of cryptocurrency.

Zutopia aims to improve safety using credit card checks and amount holds, while a transaction between peers is underway.

In this process, the Zutopia platform checks the Splitchain network to see if peers have completed a transaction amongst themselves.

This means Zutopia never holds your coins—it only searches for the “receipt” of your transaction on the Splitchain network, to see if the sender and receiver have completed their ends of the process.

This makes transactions safer and more transparent to all peers involved.

It’s a very different, left-field approach to how marketplaces work.

And we like left-field approaches to complex problems here.

Meanwhile, Binance is facing some serious issues.

Binance is a huge business and if parts of its US division close down, it would raise doubts about the centralized platforms’ ability to provide its ongoing crypto exchange services, at least in the capacity it has been doing.

Legal problems can be tricky for all kinds of crypto platforms, and Binance is no exception, big or small.

It’s facing legal action from the US government, restrictions from Europe, and going by reports, seems to be losing activity in the US.

Recent events, like top executives leaving Binance and possible criminal charges, are damaging public trust in the platform.

In contrast, Zutopia’s focus on safety, peer-to-peer transactions, and user empowerment aims to build stronger user trust.

Centralized exchanges have helped the crypto industry grow, but face significant challenges as regulators clamp down on these practices.

It’s all the more reason to focus on problem-solving applications of the fundamental crypto technology, as we regularly cover here.

This will, in time, turn the speculative nature of the crypto industry into a far more dependable and useful industry.

That’s what Splitchain has been designed to do.

It’s designed to solve numerous issues traditional blockchain technology is struggling to grapple with, so that it can be used for all kinds of everyday tasks, far beyond speculative trading.

If you liked this newsletter, please forward it to someone who might like it too.

You can also donate here or even buy some Zucoins. Every little bit helps us improve.

What did you think of this newsletter? Reply to send us feedback on what you liked or want to see featured more. There’s more coming, so stay tuned.

—

All the best,

Peter & Rob

MyZucoins

Disclaimer: Of course, this is not advice, financial or otherwise. It’s also important to consider the risks and challenges associated with any potential benefits.