Welcome, and thank you for being part of the MyZucoins community! Let’s get into an interesting piece of crypto, finance, or tech news to stay ahead.

US Gov Treasury Faces Global Credit Rating Downgrade Due To Financial And Political Strains

Moody’s Investors Service, a top US investments rating agency, has revised the US credit outlook to negative, signifying potential economic instability.

This change arises from concerns over increasing budget deficits and deepening political divisions.

Despite maintaining the highest AAA rating, the US risks a downgrade if fiscal issues persist.

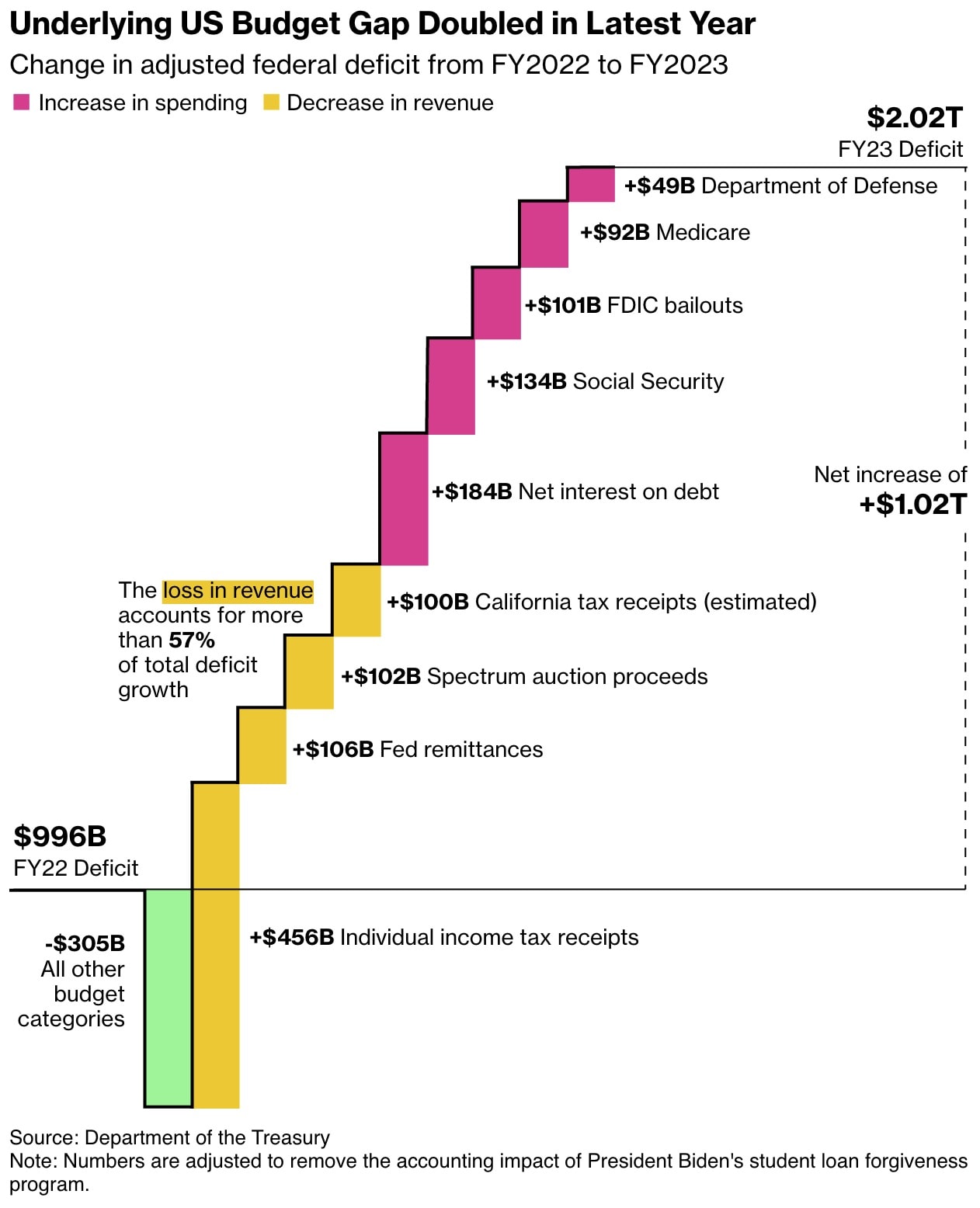

Soaring deficits, largely from higher spending and lower revenue, have led to a doubling of the federal deficit to $2 trillion.

Moody’s highlights the challenge of “debt affordability” amid deficits of around 6% of GDP and rising interest rates.

Following Fitch and S&P’s downgrades, Moody’s is the only agency still awarding the US a top rating.

Political events, such as near government shutdowns, heighten the likelihood of further credit rating deterioration.

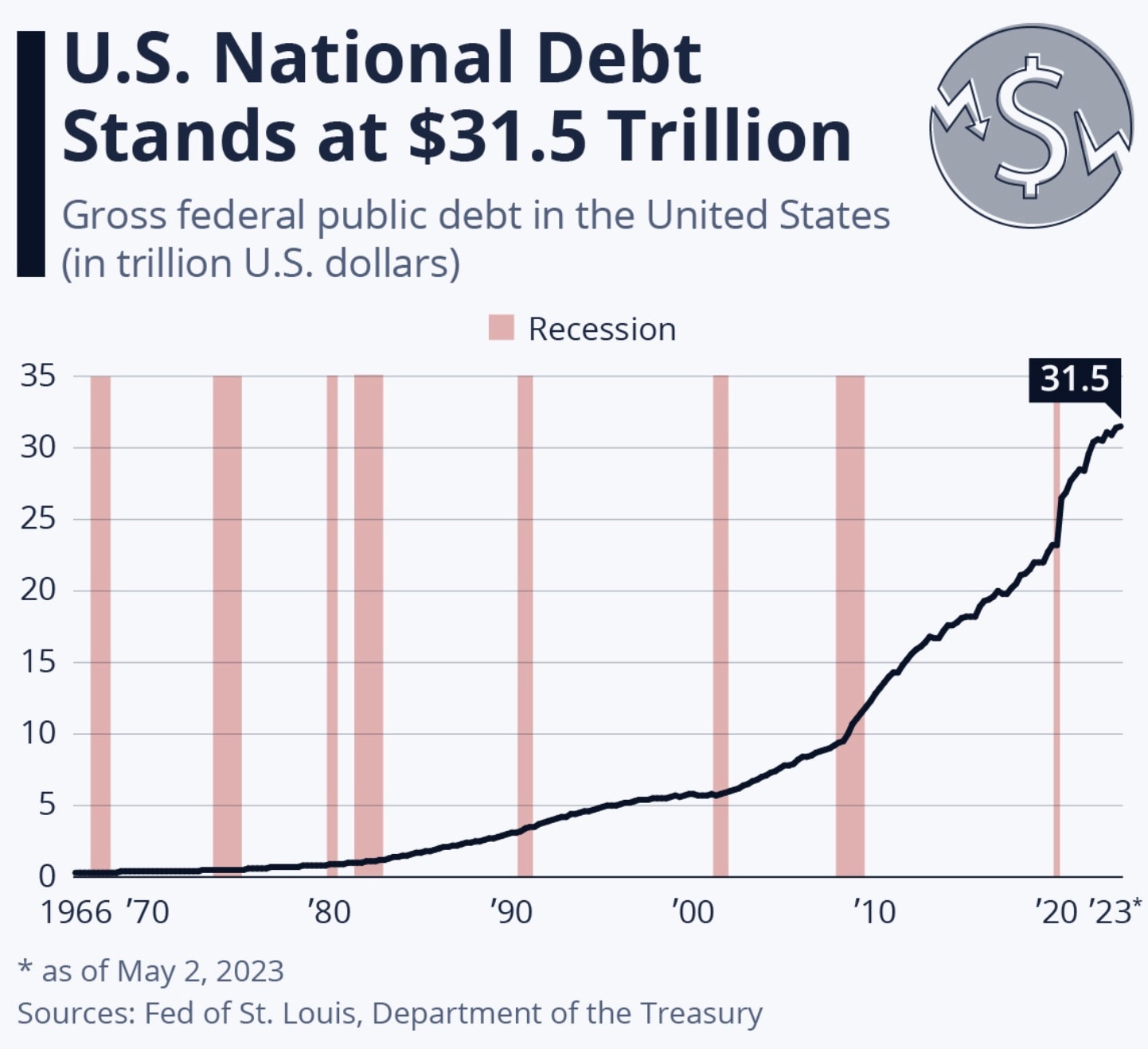

Surging long-term Treasury yields, the highest in 16 years, reflect mounting concerns over the US’s growing debt.

Note the concerning exponential growth curve for US treasury debt.

Moody’s projects a sharp rise in federal interest payments, estimating they will reach about 26% of revenue and 4.5% of GDP by 2033, up from 9.7% and 1.9% in 2022.

With a potential government shutdown looming and the 2024 elections approaching, resolving fiscal issues becomes increasingly complex for the US.

Moody’s suggests that addressing the negative outlook might not occur until 2025, requiring significant fiscal reforms.

Read more here and here.

Is the US dollar’s reserve currency position at risk?

Fiat currencies eventually fail.

More than half of Turkey has turned to crypto amid rapid 50% currency devaluation.

BlackRock’s CEO Larry Fink sees Bitcoin as the “digital gold equivalent”.

How Can Digital Assets Defend Against Government Debt And Inflation?

Bitcoin and Zucoin, both digital assets, could provide an efficient way of value transfer in a setting where traditional interest rates are skyrocketing.

In a scenario where federal interest payments are escalating in correlation to revenue and GDP, Zucoin’s inherent design, including a limited supply of 100 million coins and lack of a mining process could provide an alternative to both.

Zucoin, as a digital asset, operates beyond the traditional debt and interest model, introducing a different viewpoint on value structure.

Actions by the government to trim deficits through decreased spending or increased revenues (taxes) are seen as a need, though it risks upsetting the popularity of the current political party in power, so most leaders just choose to focus on short-term solutions and kick the issue down the road, making it worse when it crops up again.

The government could focus on productivity funding like major infrastructure projects that benefit the nation over decades, but these result in more government debt, worsening the issue in the short term.

Ray Dalio, a prominent investor and hedge fund manager, has extensively discussed the changing world order and its impact on economies, especially concerning national debt and productivity.

Dalio highlights that large debts and declining productivity are often signs of a country reaching the limits of its debt cycle, leading to major economic shifts.

It’s a key factor that the Zucoin team is very aware of, hence the focus on maximizing productivity.

Dalio points out that these shifts can lead to the devaluation of a nation’s local (fiat) currency and increased financial instability.

Most of the time, people assume everything is getting more expensive, but the real reason is the local currency is simply getting weaker, usually because more of it is floating around.

The decentralized nature of Bitcoin and increasingly Zucoin means it isn’t tied to the fiscal policies of any single country, making it potentially more stable during times of economic upheaval.

Time will tell if this is the case, but both cryptocurrencies have limited supplies, 21 million for Bitcoin, and 100 million for Zucoins.

Dalio’s analysis indicates that in an era of declining productivity and rising national debt, assets that increase productivity or are fundamental commodities could become more attractive.

Cryptocurrency’s potential to provide a hedge against inflation and currency devaluation aligns with Dalio’s views on protecting wealth in changing economic orders.

Zucoin’s alternative to blockchain technology, Splitchain, ensures transparency and innovates on safety, helping an environment where trust in traditional systems is waning.

It seems there are clear signals emerging that 2024 will be a bumpy year for the US and many other nations, but what will alternative assets like cryptocurrencies do in this environment?

If you liked this newsletter, please forward it to someone who might like it too.

You can also donate here or even buy some Zucoins. Every little bit helps us improve.

What did you think of this newsletter? Reply to send us feedback on what you liked or want to see featured more. There’s more coming, so stay tuned.

—

All the best,

—Rob

MyZucoins

Disclaimer: Of course, this is not advice, financial or otherwise. It’s also important to consider the risks and challenges associated with any potential benefits.