Centralisation Threatens Blockchain’s Decentralisation Promise

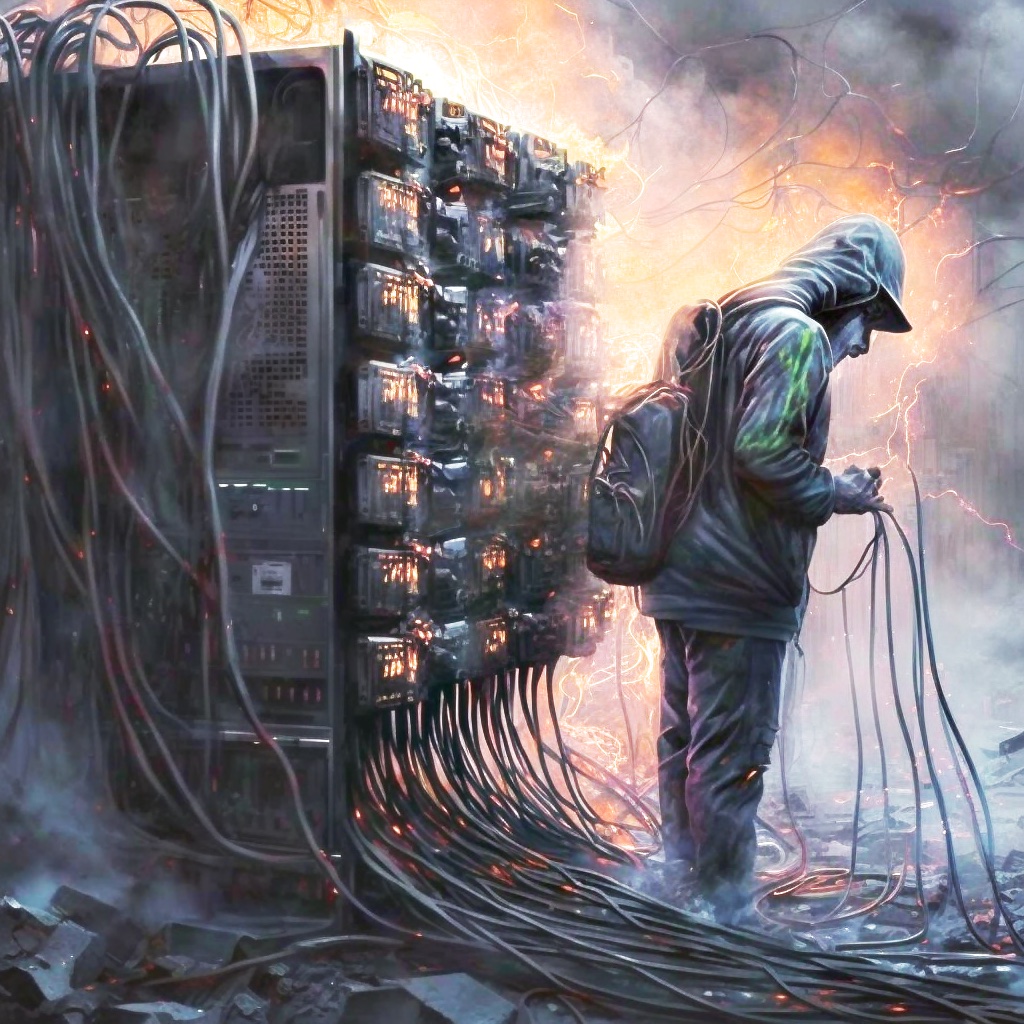

Blockchain technology, introduced in 2008, aimed to address issues of trust, security, decentralisation, and efficiency in digital transactions. However, the blockchain industry faces challenges, including a lack of diversity, wealth control by a few holders, hash rate problems, and loss of decentralisation.

Bitcoin’s hash rate, the computing power necessary for transaction validation and block production, poses several challenges. High energy consumption for maintaining the hash rate raises environmental concerns. Centralisation of mining power in large mining pools leads to potential monopolisation and 51% attacks, threatening network security. Additionally, the limited scalability of the Bitcoin network results in congested transactions and high fees, hampering its functionality as a payment system.

The blockchain industry has fallen into a power imbalance resembling traditional finance, with wealth and power concentrated in a small group. High barriers to entry and network effects contribute to this imbalance. Possible solutions include using renewable energy sources for mining operations, improving underlying technology for increased scalability, and educating people about blockchain technology and its potential through accessible resources, training programs, and integration into educational curricula. Read more here.

The goal with Splitchain and Zucoins is to create a revolutionary alternative to blockchain by eliminating mining operations and introducing a unique truth algorithm. This groundbreaking approach tackles centralisation issues and promises a more accessible, eco-friendly and efficient exchange of value.

The unique truth algorithm at the heart of Splitchain Network eradicates the need for mining operations. By doing so, it addresses concerns regarding environmental impact and energy consumption, which have been significant drawbacks of conventional blockchain technology.

Furthermore, the absence of mining operations reduces the possibility of power concentrating into a few central control points. This approach helps maintain a more decentralised system, minimising monopolisation and mitigating risks associated with 51% attacks.

Additionally, the Splitchain network’s scalability solutions enable it to handle increased numbers of users and transactions without sacrificing speed and efficiency. Continuous improvements to the underlying technology and the adoption of innovative protocols ensure an effective and decentralised value exchange system that caters to a wide audience.

Zucoins on the Splitchain network stands out as a game-changer in the blockchain industry, offering a revolutionary alternative that champions truer decentralisation, sustainability, scalability, and no transaction fees.

Aussie Crypto Exchange CoinJar Seizes US Opportunities Amid Regulatory Hurdles

Australian cryptocurrency exchange CoinJar is expanding into the US market, undeterred by the nation’s regulatory challenges. CoinJar CEO Asher Tan views these challenges as an opportunity, believing that the American market will reward an exchange with strong compliance credentials. Founded in 2013, CoinJar has a user base of approximately 500,000 customers across Australia and the United Kingdom.

CoinJar is hiring an Anti-Money Laundering (AML) compliance officer to initiate its US expansion. Tan suggests that the company’s focus on regulatory compliance will enable it to succeed in the US market. CoinJar plans to gradually obtain licenses in each state to achieve near-full coverage.

However, the experience of rival US-based crypto exchange Coinbase highlights the potential obstacles CoinJar may face. Despite actively engaging with the Securities and Exchange Commission (SEC) in pursuit of compliance, Coinbase received a Wells notice threatening legal action over offerings the SEC deemed to be violating securities law. Coinbase has since petitioned the federal court to request clearer regulatory guidelines for the US cryptocurrency industry. Read more here.

Crypto Industry Responds to UK’s Proposed Regulatory Framework

The UK’s HM Treasury received feedback on its consultation paper and call for evidence on a proposed crypto asset regulatory framework, with submissions from key industry players like Polygon Labs, Andreessen Horowitz, the Association for Financial Markets in Europe (AFME), and the Digital Pound Foundation. The central issues raised were the principle of “same risk, same regulatory outcome” and the emphasis on regulating activities instead of assets.

Polygon Labs proposed revising the principle to “different source of risk, same regulatory outcome”, emphasising the distinction between centralised finance (CeFi) and decentralised finance (DeFi). The AFME underscored the necessity for a global crypto-asset taxonomy and highlighted the wider territorial scope of the suggested regulations compared to traditional assets.

The UK government will now assess the collected responses, with further consultations on specific rules being considered if needed. As the next steps unfold, industry stakeholders will be closely watching developments in this regulatory landscape. Read more here.

US Bank Failures Ignite Call for Reform

US Democrats demand increased regulation of the US financial sector after the third major bank failure in recent months, with First Republic Bank’s collapse prompting a government-administered bailout. Senate Banking Committee Chairman Sherrod Brown emphasises the need for stronger guardrails to protect financial stability and ensure competition. The FDIC will spend approximately $13 billion from the Deposit Insurance Fund to clean up First Republic’s collapse. JPMorgan Chase will receive $50 billion in fixed-rate financing as it takes on the bank’s assets, loans, and deposits.

Critics argue that this bailout puts taxpayer money at risk, with $25 billion used from the Treasury’s Exchange Stabilisation Fund to backstop a loan for the rescue of depositors at Silicon Valley Bank in March. Senator Elizabeth Warren insists that Congress must make significant reforms to fix a broken banking system. Other top US Democrats defend the Biden administration’s actions but encourage banking sector reforms.

First Republic’s failure (Now the second-biggest US bank failure) occurs as lawmakers and regulators investigate the collapses of Silicon Valley Bank and Signature Bank. House Financial Services Committee member Rep. Brad Sherman blames regulators, while Rep. Maxine Waters highlights reports showing both Federal Reserve regulators and bank managers were responsible for the collapses. The frustration over more bank failures and government caretaking extends beyond the Democratic party.

Experts warn that the period of bank failures may not be over, and their impact on the wider economy is not yet fully understood. We covered some of this topic here, by the way. The future of the banking industry and the potential dominance of the largest banks remain uncertain, as regulators have tried to prevent the biggest banks from becoming more dominant since the 2008 financial crisis. Read more here.

As faith in traditional banking systems dwindles, the demand for decentralised finance (DeFi) solutions is poised to grow. Zucoin, powered by the advanced Splitchain network, is well-positioned to seize this opportunity, providing a compelling alternative to conventional financial systems. This surge in interest could accelerate the adoption and expansion of Zucoin and the Splitchain network.

The ongoing financial turbulence underscores the urgent need for innovative and disruptive approaches in the financial sector. Zucoin, built upon the cutting-edge Splitchain network, epitomises such inventiveness. Offering a technologically distinct alternative to conventional blockchain-based digital assets, Zucoins has the potential to drive transformative changes in the financial landscape.

What did you think of this newsletter? Reply to send me feedback on what you liked or want to see featured more. There’s more coming, so stay tuned.

If you liked this newsletter and want to support my work, the best way is to forward this newsletter to someone, donate here or even buy some Zucoins.

—

All the best,

Peter

MyZucoins